Unwrap 2024 Savings Today!

QuickBooks Online Unwraps Savings for the Holidays!** 🎁

As the holiday season approaches, there's no better time to sleigh your financial goals with QuickBooks Online. 🚀✨ Join us on a journey of financial merriment and discover how QuickBooks Online can be your holiday helper, bringing cheer and savings to your year-end festivities.

Unwrapping the Magic of QuickBooks Online for the Holidays! 🛍️📊

Holiday Budgeting Bliss:

Tired of tangled holiday budgets? QuickBooks Online is here to streamline your expense tracking. Categorize your festive spending with ease and watch your budget stay as merry as your celebrations.

Exclusive Discounts and Deals:

'Tis the season for savings! Click https://quickbooks.grsm.io/785rn5w9mi50 to unveil exclusive holiday deals on QuickBooks Online. It's our gift to you for a jolly financial season.

Cheers to Year-End Reports:

Bid farewell to financial chaos and welcome stress-free tax preparation. QuickBooks Online offers customizable year-end reports, ensuring you start the New Year on a financially organized note.

Virtual Collaboration for Businesses:

If you're running a business, QuickBooks Online fosters seamless collaboration. Ensure everyone in your team is on the same festive financial page, spreading virtual cheers and boosting productivity. 🥂🎉

Share the Financial Joy:

Love the financial magic QuickBooks Online brought to your holidays? Share the joy with friends and family! Tag them in the comments and let's make this holiday season the merriest one yet.

Claim Your Discount and Sleigh Your Financial Goals! 🎅🌟

It’s better to be ready then to have to get ready!!!

Take steps to prep now that will help you file federal tax returns timely and accurately in

2024. See #IRS tips to #GetReady: www.irs.gov/getready

2024 Tax Refund Calendar

Stay ahead of the game this tax season by keeping a close eye on the 2024 IRS Tax Refund Calendar! Our latest blog post is your go-to resource for staying up-to-date on crucial dates and deadlines. Whether you’re anticipating a refund or planning your financial strategy, this calendar has you covered.

IRS ERC Withdraw Option!

Did you fall victim to an Employee Retention Credit promoter scam? If the incorrect #ERC or #ERTC claim hasn’t been processed, #IRS has a special withdrawal option to help you: https://ow.ly/5ygU50PYKaF

#IRS has a withdrawal option for those who have an unprocessed Employee Retention Credit. If you filed an incorrect claim, take a look at the special #IRS guidelines: https://ow.ly/5ygU50PYKaF #ERC #ERTC

Tax Counseling for the Elderly

The #IRS Tax Counseling for the Elderly program offers free tax preparation that help

people in need, right in your community. Support this effort by volunteering today:

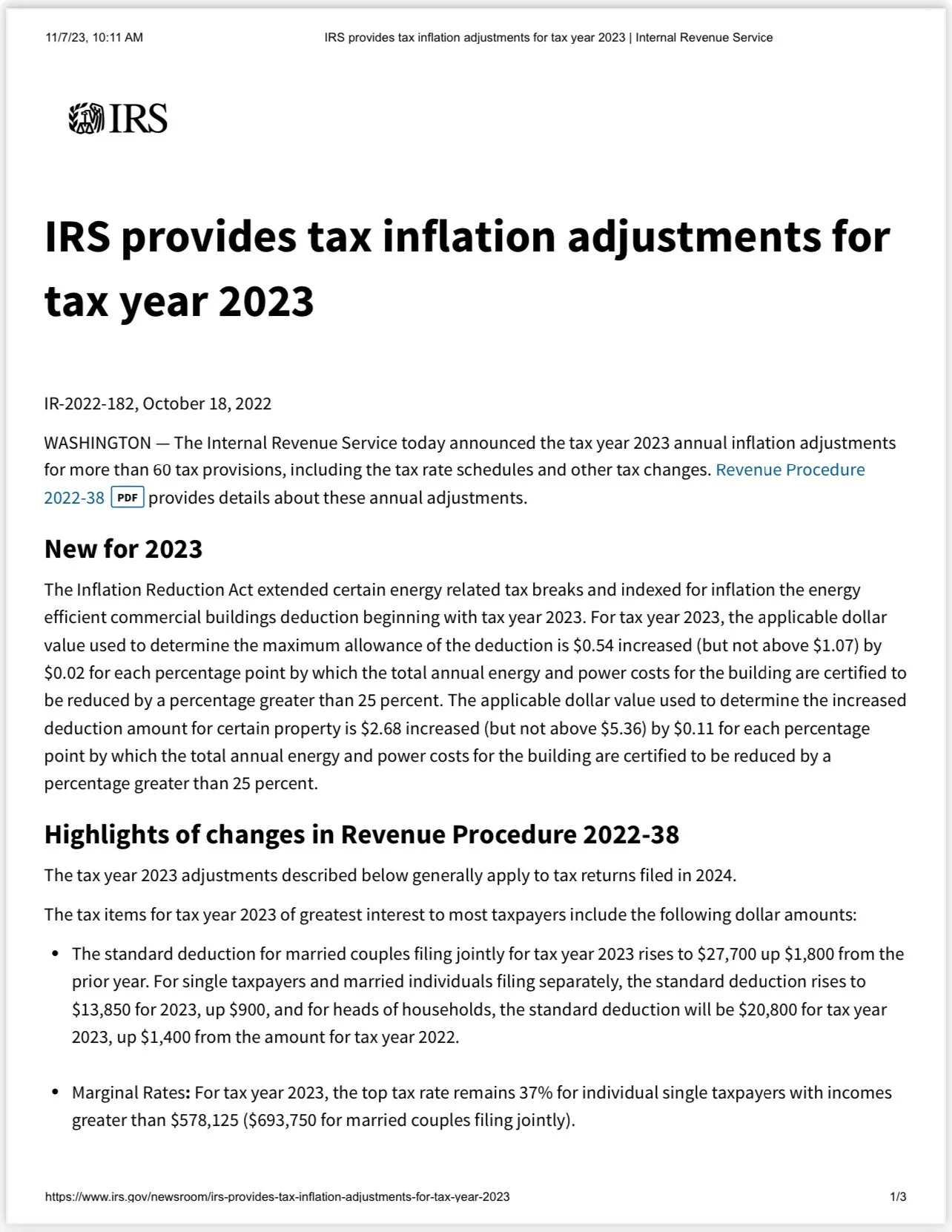

IRS Provided Tax Adjustments for 2023

WASHINGTON — The Internal Revenue Service today announced the tax year 2023 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes.

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023

Don’t Get Scammed! Must Read!

Many people are giving to charities in response to acts of violence and natural disasters. #IRS warns everyone to watch for criminals soliciting donations and falsely posing as legitimate organizations.

See: www.irs.gov/teos

IRS Extension Upcoming Deadlines….

If you requested an extension from the #IRS, you have until 10/16 to file your tax return. Read:

Taxpayers to prepare and file federal income tax returns online using guided tax preparation software.

For more info: https://ow.ly/oORY50PS74q

#IRS reminder: The 10/16 tax filing extension deadline nears for millions of taxpayers. This includes

disaster-area taxpayers in most of California and in parts of Alabama and Georgia.

NEED A JOB? THE IRS IS HIRING!

No need to relocate for a federal job: The #IRS has amazing job opportunities in locations nationwide. Get started at: www.jobs.irs.gov You don’t have to go far to find a great career path with the #IRS. We’re hiring in hundreds of locations nationwide. Explore our job openings at: www.jobs.irs.gov

Take a look at the current #IRS job opportunities → One small step on @USAjobs can become one giant leap for your career. Get started at: www.jobs.irs.gov

If you’re ready for your career to launch onto another level, check out the exciting job openings now available at the #IRS: www.jobs.irs.gov

No need to relocate for a federal job: The #IRS has amazing job opportunities in locations nationwide. Get started at: www.jobs.irs.gov

You don’t have to go far to find a great career path with the #IRS. We’re hiring in hundreds of locations nationwide. Explore our job openings at: www.jobs.irs.gov

Take a look at the current #IRS job opportunities → One small step on @USAjobs can become one giant leap for your career. Get started at: www.jobs.irs.gov

If you’re ready for your career to launch onto another level, check out the exciting job openings now available at the #IRS: www.jobs.irs.gov

IRS Disaster Relief

Hurricane Lee

#HurricaneLee victims in parts of Maine and Massachusetts now have until Feb. 15, 2024, to file various #IRS individual and business tax returns and make tax payments. Learn more: www.irs.gov/disasters

#IRS extends upcoming deadlines, provides other tax relief for victims of #HurricaneLee in parts of Maine and Massachusetts: www.irs.gov/disasters

#IRS grants tax relief to victims of #HurricaneLee Maine and Massachusetts. Taxpayers in affected areas now have additional time, until Feb. 15, 2024, for certain tax filings and payments. See www.irs.gov/disasters

Tax relief is now available to victims of #HurricaneLee in parts of Maine and Massachusetts, as part of a coordinated federal response based on damage assessments by @FEMA. For #IRS information on this, visit www.irs.gov/disasters

Victims of #HurricaneLee in parts of Maine and Massachusetts now have until Feb. 15, 2024, to file various individual and business tax returns and make tax payments. Read more on #IRS relief at: www.irs.gov/disasters

Hurricane Lee

#HurricaneLee victims in parts of Maine and Massachusetts now have until Feb. 15, 2024, to file various #IRS individual and business tax returns and make tax payments. Learn more: www.irs.gov/disasters

#IRS extends upcoming deadlines, provides other tax relief for victims of #HurricaneLee in parts of Maine and Massachusetts: www.irs.gov/disasters

#IRS grants tax relief to victims of #HurricaneLee Maine and Massachusetts. Taxpayers in affected areas now have additional time, until Feb. 15, 2024, for certain tax filings and payments. See www.irs.gov/disasters

Tax relief is now available to victims of #HurricaneLee in parts of Maine and Massachusetts, as part of a coordinated federal response based on damage assessments by @FEMA. For #IRS information on this, visit www.irs.gov/disasters

Victims of #HurricaneLee in parts of Maine and Massachusetts now have until Feb. 15, 2024, to file various individual and business tax returns and make tax payments. Read more on #IRS relief at: www.irs.gov/disasters

Inside IRS Data: From Collection to Clarity

It’s not a lottery: You can use an #IRS online tool to check details about your federal taxes,

including balance, payments, tax records and more. See www.irs.gov/account.

Check your tax account online. You can access your #IRS records, view your payments or

It’s not a lottery: You can use an #IRS online tool to check details about your federal taxes,

including balance, payments, tax records and more. See www.irs.gov/account.

Check your tax account online. You can access your #IRS records, view your payments or

make new ones. Visit http://www.irs.gov/account.

#IRS has an online tool that allows you to check details about your federal taxes. See

DON’T GET SCAMMED THIS TAX SEASON. CHECK HERE EVERY TAX SEASON.

WASHINGTON — The Internal Revenue Service wrapped up the annual Dirty Dozen list of tax scams for 2023 with a reminder for taxpayers, businesses and tax professionals to watch out for these schemes throughout the year, not just during tax season.

Many of these schemes peak during filing season as people prepare their tax returns. In reality, these scams can occur throughout the year as fraudsters look for ways to steal money, personal information, data and more.

To help people watch out for these scams, the IRS and the Security Summit partners are providing an overview recapping this year's Dirty Dozen scams.

2023 Dirty Dozen Summary

WASHINGTON — The Internal Revenue Service wrapped up the annual Dirty Dozen list of tax scams for 2023 with a reminder for taxpayers, businesses and tax professionals to watch out for these schemes throughout the year, not just during tax season.

Many of these schemes peak during filing season as people prepare their tax returns. In reality, these scams can occur throughout the year as fraudsters look for ways to steal money, personal information, data and more.

To help people watch out for these scams, the IRS and the Security Summit partners are providing an overview recapping this year's Dirty Dozen scams.

"Scammers are coming up with new ways all the time to try to steal information from taxpayers," said IRS Commissioner Danny Werfel. "People should be wary and avoid sharing sensitive personal data over the phone, email or social media to avoid getting caught up in these scams. And people should always remember to be wary if a tax deal sounds too good to be true."

Working together as the Security Summit, the IRS, state tax agencies and the nation's tax industry, including tax professionals, have taken numerous steps since 2015 to warn people about common scams and schemes during tax season and beyond that can increase the risk of identity theft. The Security Summit initiative is committed to protecting taxpayers, businesses and the tax system from scammers and identity thieves.

Some items on this year's list were new and some made a return visit. While the list is not a legal document or a formal listing of agency enforcement priorities, it is intended to alert taxpayers and the tax professional community about various scams and schemes.