Our Credit Repair Services

1. Credit Report Analysis

We provide a detailed review of your credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion) to identify inaccuracies, outdated items, or negative accounts that may be impacting your score.

2. Dispute Inaccurate Items

We challenge and dispute unverifiable or inaccurate items on your credit report, including late payments, collections, charge-offs, bankruptcies, and more working directly with the credit bureaus and creditors.

3. Debt Validation & Creditor Challenges

We request validation from creditors and collection agencies to ensure that reported debts are legally verifiable and accurate. If not, we pursue removal.

4. Personalized Credit Repair Plan

Every client receives a custom action plan designed to address their unique credit profile, financial goals, and challenges.

5. Credit Education & Coaching

We educate you on how credit works and how to maintain healthy credit habits. Our one-on-one coaching helps you avoid future pitfalls and build lasting credit success.

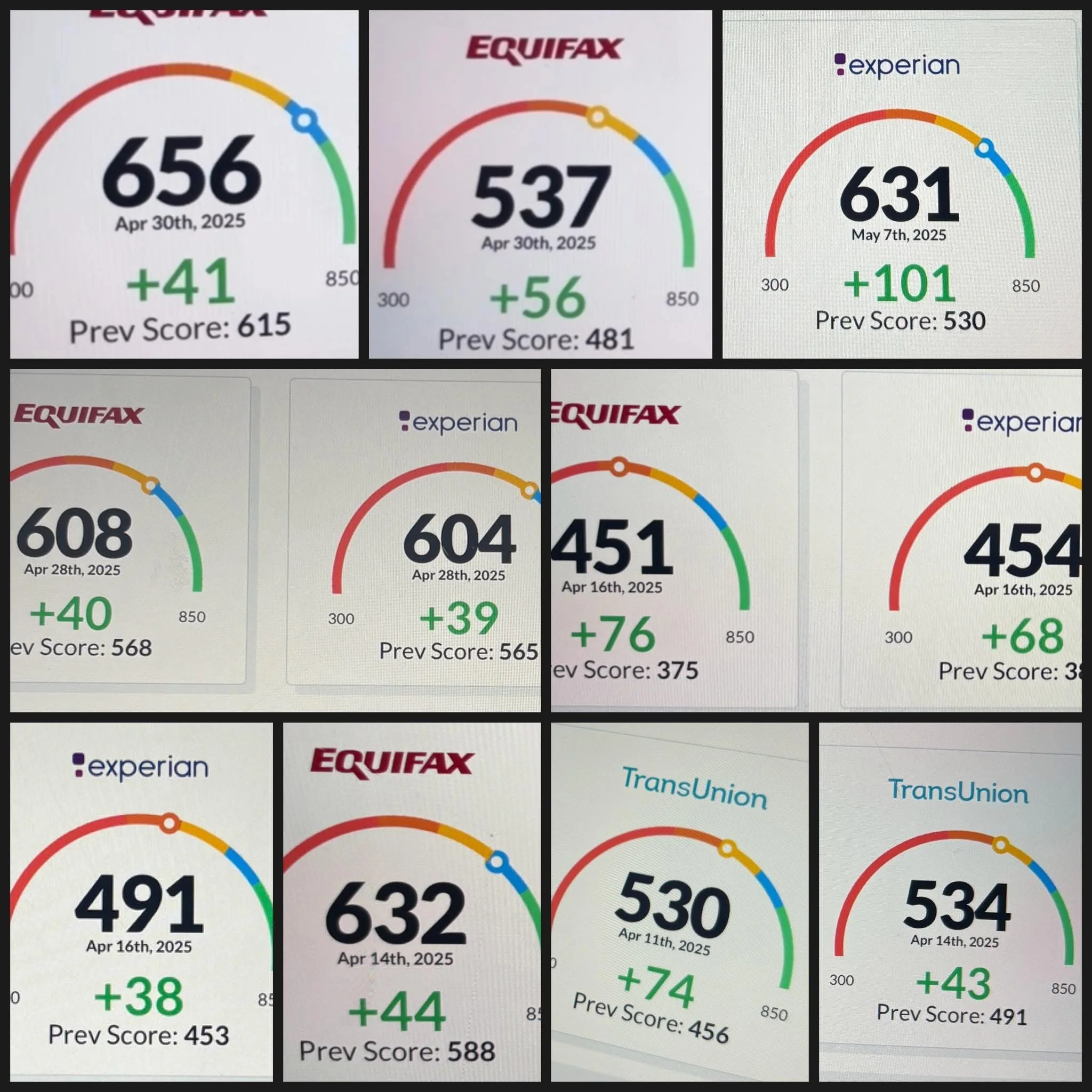

6. Monthly Progress Updates

Track your improvement over time with consistent monthly updates, showing what's been removed, improved, or resolved on your reports.

7. Assistance with Building Positive Credit

We provide recommendations and resources to help you add positive accounts to your credit profile, such as secured credit cards or credit builder loans.

8. Identity Theft Support

If your credit has been impacted by identity theft or fraud, we help you take the necessary steps to recover and protect your identity moving forward.

9. Exclusive Tradeline List Access (After 90 Days) One Free Trade.

After 90 days of active credit repair, we provide access to our exclusive trade-line list and add one free trade to all clients active in system trusted tools that can help boost your credit score even faster by adding positive payment history.